Strategy: You and your Board

We are often asked, ‘What role should the board play in strategy development?’ The short and easy answer is that boards should provide direction, ownership, and implementation oversight to management to achieve the desired strategic outcomes. Of course, the steps involved are more complex. At Gullone Group, we offer insights into the optimal contribution that boards and management can make and how to make it.

First, make sure you have the right mix of expertise on the board. Board members will have differing views and backgrounds in strategy development, and their combined potential should be aligned cohesively to best serve the future requirements of the organisation. Boards may be keen to move into a new strategic direction, and importing a new board member with talent or expertise in that area may be useful. The person does not have to be a fully fledged Board member. An option, particularly if the new strategic initiative is project-specific or has a short limited life span, may be to appoint an Advisory Board member with relevant experience to round out board skills. For example, it may be appropriate to recruit an Advisory Board member with relevant skills in mergers if a merger is being contemplated.

Second, engage in best-practice governance. At Gullone Group, we believe that there is a direct link between best-practice governance and strategic leadership. Responding to boards' roles in strategy setting is more difficult if there is little formal delineation between the board's and management's roles. It is difficult to create an effective boundary within which to operate if the fence cannot be seen. When the board’s expected contribution is agreed upon, it should be specified in the governance charter.

In a best-practice governance environment, the organisation’s governance charter will assist in developing strategic and business plans. The charter should outline the parameters of planning and clarify directors' roles in planning. A well-thought-out governance charter will also assist management in managing the planning process and interacting with the board and throughout the organisation.

Third, determine what level of involvement the board will have in the development of the strategic plan. A strategic plan outlines an organisation’s desired future direction. As soon as the organisation assumes a structure that adds management layers, it exponentially intensifies the demand for communicating a clear and aligned direction. So, the strategic plan becomes a physical manifestation of clear leadership in a multi-layered organisation. If an organisation has layers of management, it should also have a strategic plan.

Overall, the role of the board is to provide leadership and guidance to management in the development of the strategic plan and ultimately take ownership of the plan. Traditionally, the board was thought of only as setting initial strategic objectives, then reviewing, endorsing or approving the strategic plan presented by management. In recent years, this has changed, and leading boards are now more closely involved with management throughout the whole strategic planning process. All directors, including non-executive directors, are legally responsible to exercise ‘independent judgement over the company’s strategy’ (Justice Owen, HIH Royal Commission 2003, volume 3, section 6.2.3). This requirement has become even more pronounced after the 2018 Hayne Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

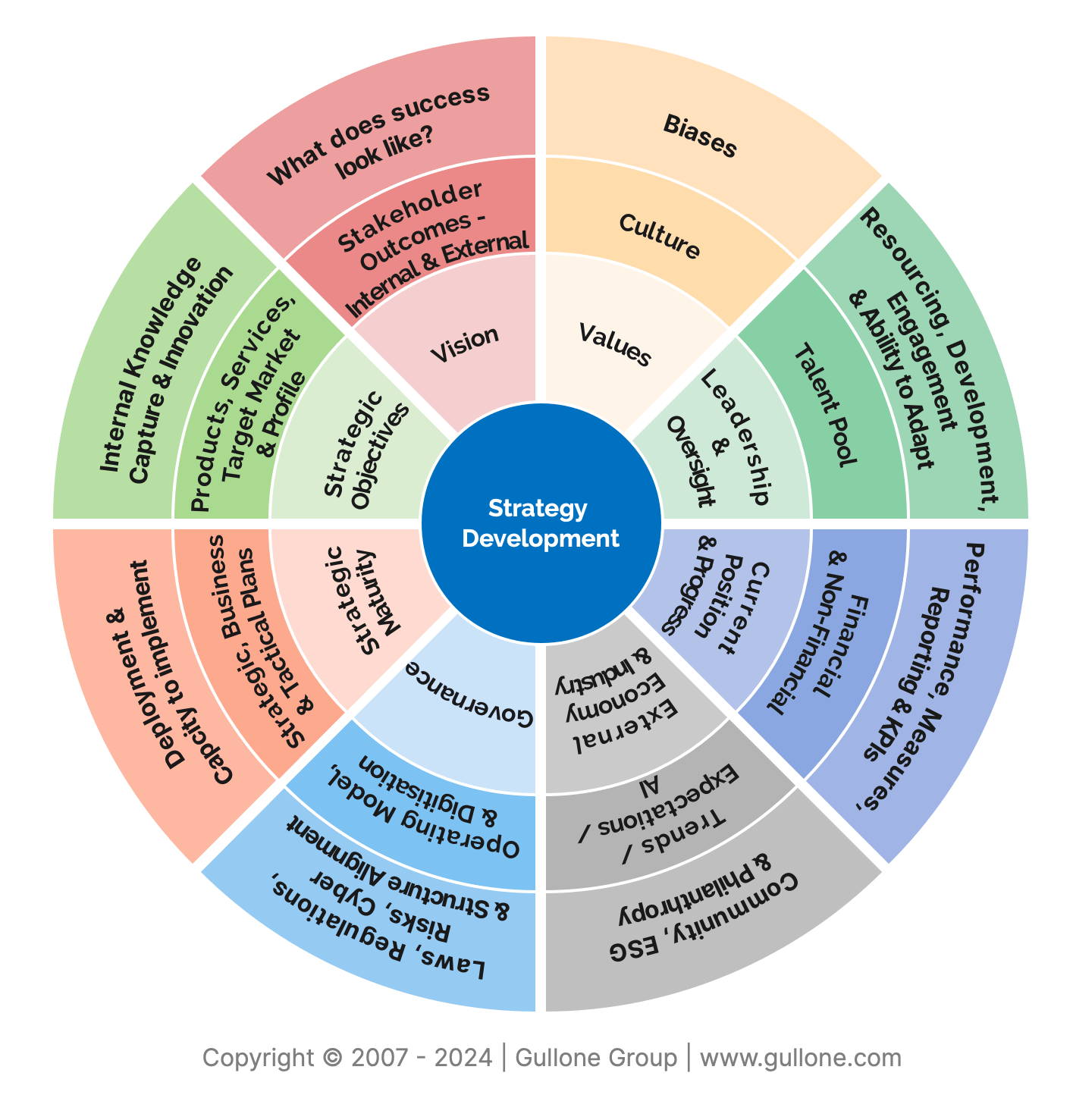

It must be remembered that each board is different and has a different level of involvement in strategy development. The following diagram summarises the key areas that should be considered when determining the level of involvement in strategy formation.

It must be remembered that each board is different and has a different level of involvement in strategy development. The following diagram summarises the key areas that should be considered when determining the level of involvement in strategy formation.

When developing the strategic plan, strategic risks (e.g. skills shortage, service level failures) and opportunities should be considered. The board and CEO, with their networks to the external environment, will likely have much to offer in this identification. The CEO and management will contribute here, too, as they are often the most capable assessors of the organisation’s progress and resources. A holistic view offers the best opportunity to develop a cohesive strategy that intends to take advantage of the organisation’s changing environment.

Each board must determine its own level of direct involvement in the strategy formation process. Above all, the board’s involvement should be based on adding value to strategy formation rather than approving it without thought. Directors need to convey strategic insight and understand that strategic success is predominantly based on the successful implementation of strategy. That requires a desire to work with, guide and develop management throughout the entire strategic process. There is no point in being involved in strategy formation if a director is mainly interested in promoting self-interest or has a totally biased view. This will stifle strategic planning and most likely de-motivate others involved in the process. Besides being good practice, it must be remembered that directors have a legal duty to guide strategy formation and act in the best interest of the organisation's key stakeholders (e.g. shareholders, customers, members, staff, community).

Lastly, implementation and regular review of the strategic plans are critically important. The board needs to work with management to ensure time frames, resourcing, and priority setting are appropriate and realistic. Efficient and effective reporting mechanisms (e.g. dashboard, scorecards) need to be put in place and regularly updated and monitored by the board. The board should have an ongoing dialogue with management and agree on authority parameters for changing strategic plans and underlying actions.

A sign of good governance is a well thought out and relevant strategy that is regularly reviewed and updated for emerging trends and as new information comes to hand. Consider the spectacular strategic failure of Eastman Kodak during the rise of digital photography. Kodak stuck to its outdated print processing while new competitors were adopting digital technology that Kodak had actually developed. Strategic complacency and inertia had firmly set in at Kodak. After many legal battles from the late 1990s to regain market share, Kodak filed for Chapter 11 Bankruptcy Protection in the United States in 2012. The Kodak board effectively became bystanders in a market that the company had dominated for over a century.

Boards should monitor strategic success by referring to the strategic plan and assessing performance against financial (e.g. ROI, EPS) and non-financial key performance (e.g. market share, staff turnover, staff engagement, service levels) indicators. Boards should also assess the performance of sub-action plans or tactical plans (e.g. product development, product launch).

There should be clarity in the role of the board and management in every step of the strategic planning and implementation process. Role clarity works best when it is enshrined in governance charters and position descriptions, and each party is held accountable. The board's and management's role clarity of responsibilities can also help boards assess their own performance and identify how they have added value to the organisation’s strategic progress.

Insights Article - Thought Leadership | gullonegroup | gullone.com | All Rights Reserved